Partners with more than 40 years of experience in non-performing loans management

Team with experience of more than US$ 15 billion in face value of credit titles collected through master servicing

Big data with more than 60 million of CPFs* and 10 million of CNPJs*

* CPFs: Cadastro de Pessoa Física: Social Security Number | CNPJs: Cadastro Nacional de Pessoa Jurídica: National Register of Legal Entity

MTZDATA manages pulverized loans portfolios, originated by private companies and the public sector.

Our group of partners accounts with:

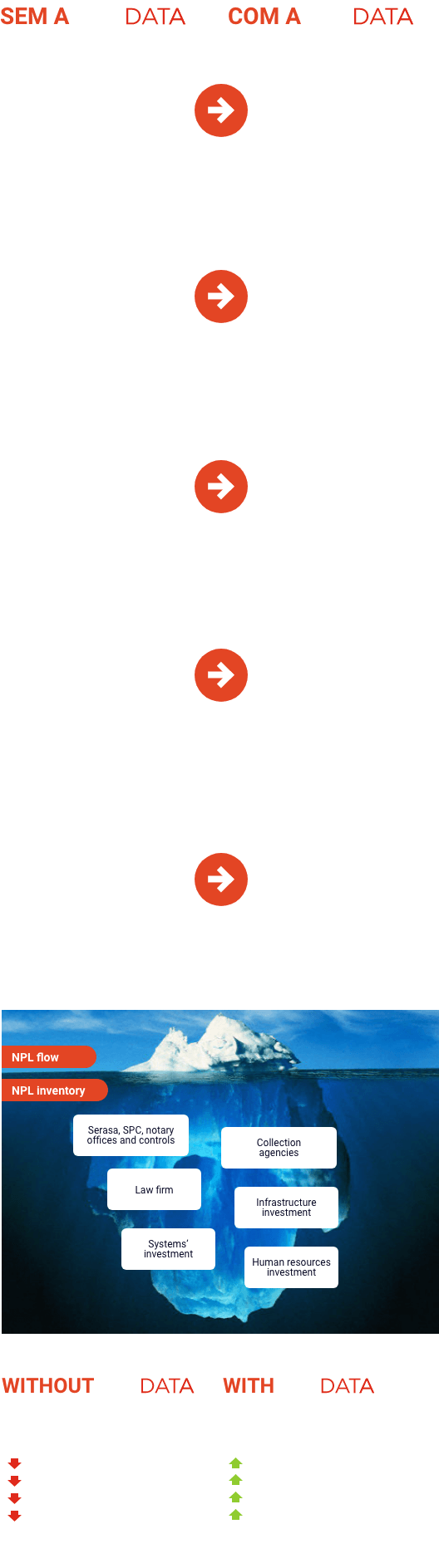

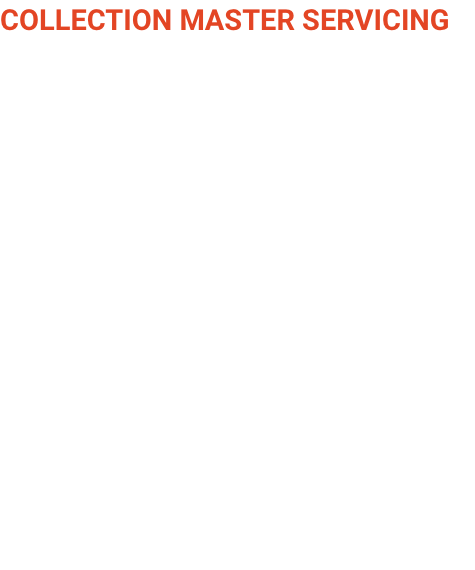

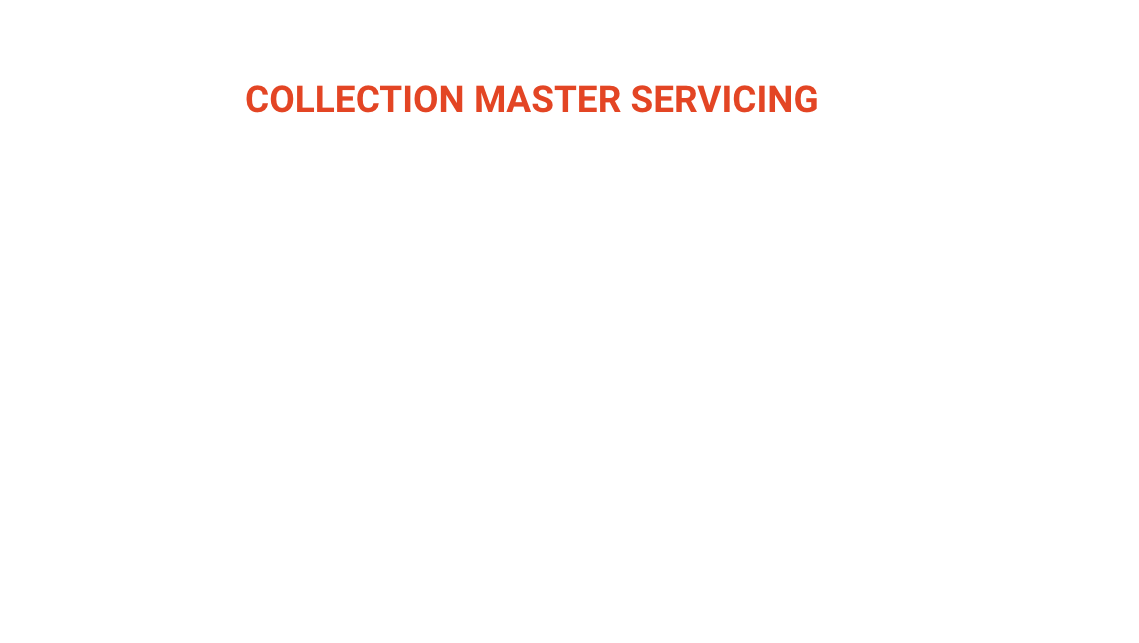

We provide master services, supporting clients in the non-performing loans recovery. Through our technological structure and data intelligence, we implement efficient collection strategies with attested performance optimization.

We develop the bridge between the client selling the non-performing loans and investors interested in acquiring these assets. We support in the entire underwriting process: planning, data base structuring and portfolio pricing, as well as in the negotiation with the investors.

Data science focus and development of artificial intelligence in order to provide services that are even more efficient

Partners with more than 40 years of experience in master servicing and NPLs portfolios’ recovery

Systems’ infrastructure with top-notch technology

Data base with +60 million CPFs and 10 million CNPJs

Partnerships with collection agencies